4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

Table of ContentsMileagewise - Reconstructing Mileage Logs Can Be Fun For AnyoneSome Known Facts About Mileagewise - Reconstructing Mileage Logs.What Does Mileagewise - Reconstructing Mileage Logs Do?The Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsLittle Known Facts About Mileagewise - Reconstructing Mileage Logs.The Ultimate Guide To Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Mean?

Timeero's Shortest Range feature recommends the quickest driving route to your staff members' destination. This feature improves productivity and adds to cost financial savings, making it a crucial property for businesses with a mobile labor force. Timeero's Suggested Course function better boosts responsibility and efficiency. Staff members can compare the recommended route with the real route taken.Such an approach to reporting and conformity simplifies the typically intricate job of managing mileage costs. There are several benefits associated with utilizing Timeero to track gas mileage. Allow's have a look at a few of the application's most significant functions. With a trusted mileage monitoring device, like Timeero there is no need to fret about accidentally omitting a date or item of details on timesheets when tax time comes.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

These extra verification steps will certainly keep the Internal revenue service from having a reason to object your gas mileage records. With precise gas mileage monitoring innovation, your staff members don't have to make rough gas mileage price quotes or also worry concerning mileage cost tracking.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all car expenses. You will certainly require to continue tracking mileage for work also if you're making use of the actual cost approach. Maintaining mileage records is the only method to different business and personal miles and supply the proof to the IRS

A lot of gas mileage trackers allow you log your trips by hand while calculating the range and repayment quantities for you. Many additionally come with real-time journey tracking - you need to start the app at the begin of your journey and stop it when you reach your final destination. These applications log your begin and end addresses, and time stamps, in addition to the complete range and reimbursement quantity.

What Does Mileagewise - Reconstructing Mileage Logs Do?

Among the concerns that The IRS states that car expenses can be taken into consideration as an "common and essential" cost during doing business. This consists of costs such as fuel, maintenance, insurance coverage, and the car's depreciation. For these prices to be taken into consideration insurance deductible, the automobile must be made use of for service functions.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

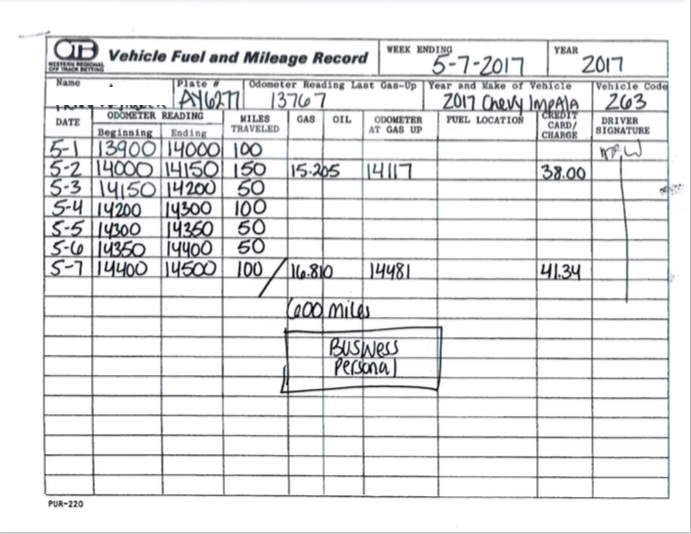

Begin by videotaping your car's odometer analysis on January first and after that once again at the end of the year. In between, carefully track all your organization journeys taking down the starting and ending readings. For every journey, record the area and business objective. This can be streamlined by keeping a driving log in your vehicle.

This includes the total company mileage and total mileage buildup for the year (company + personal), journey's date, location, and function. It's necessary to videotape tasks quickly and keep a coexisting driving log detailing date, miles driven, and business purpose. Below's exactly how you can improve record-keeping for audit objectives: Begin with making certain a careful mileage log for all business-related travel.

Little Known Facts About Mileagewise - Reconstructing Mileage Logs.

The actual expenditures method is a different to the standard mileage rate technique. As opposed to calculating your deduction based upon a fixed rate per mile, the actual expenses approach allows you to subtract the real prices connected with utilizing your vehicle for service objectives - mileage tracker. These prices consist of gas, upkeep, fixings, insurance policy, devaluation, and other related costs

Nevertheless, those with significant vehicle-related expenses or unique conditions might profit from the actual expenditures method. Please note electing S-corp status can alter this computation. Ultimately, your chosen approach needs to straighten with your specific economic goals and tax circumstance. The Requirement Mileage Price is an action provided yearly by the IRS to determine the insurance deductible expenses of operating a vehicle for service.

Examine This Report on Mileagewise - Reconstructing Mileage Logs

(https://experiment.com/users/mi1eagewise)Whenever you use your right here automobile for company trips, record the miles took a trip. At the end of the year, once again note down the odometer analysis. Determine your total organization miles by utilizing your begin and end odometer readings, and your tape-recorded business miles. Accurately tracking your precise gas mileage for service trips aids in corroborating your tax deduction, particularly if you choose the Standard Gas mileage method.

Keeping track of your mileage by hand can call for diligence, however bear in mind, it can save you money on your taxes. Videotape the total mileage driven.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

And currently almost everyone makes use of General practitioners to get around. That suggests virtually every person can be tracked as they go concerning their service.